WhatsApp Pay is a digital payment service released by Facebook that lets Users transfer money to their Contacts. This new WhatsApp Payment feature also allows Brazilian businesses to receive transactions. It certainly seems like a big step forward for the social media giant but how does it work? What do we need to make a transaction? This article explains everything you need to know about WhatsApp Pay.

WhatsApp Pay: A Brief History

WhatsApp Payment is a new business model for Facebook which takes advantage of WhatsApp’s worldwide success. So far it has reached India and Brazil, the two biggest WhatsApp markets, but Facebook has plans to eventually expand it to other locations.

Messaging apps like WeChat and Line have already developed their i9 Brazilian banks are facilitating digital payment services long ago, WeChat Pay and Line Pay. Both allow peer-to-peer transfers, but they have been successfully implemented for business transactions too.

But what about WhatsApp Pay? Is it putting enough on the table to become an established payment method?

WhatsApp Pay: What You Need to Know

The new WhatsApp Payment option is available in the app for both regular and Business Accounts. Money transfers are not too different from sharing images or videos. But before using the new feature, here are the important things you should know.

WhatsApp Payment: Free for Consumers, Not For Businesses

Currently, peer-to-peer transactions are free in India and Brazil. However, it is still unclear if Payments will be available for business accounts in India. Therefore, we will be only referring to WhatsApp Pay Brazil where WhatsApp Pay for business is available.

Only recently merchants have access to use WhatsApp Pay in their WhatsApp Business Account. While Users can send and request money to their Contacts without any additional charge, businesses must pay a 3.99% fee per received transaction.

If you are going to use WhatsApp Payment for business, what comes next will be interesting to you: We will give insight into how transactions work.

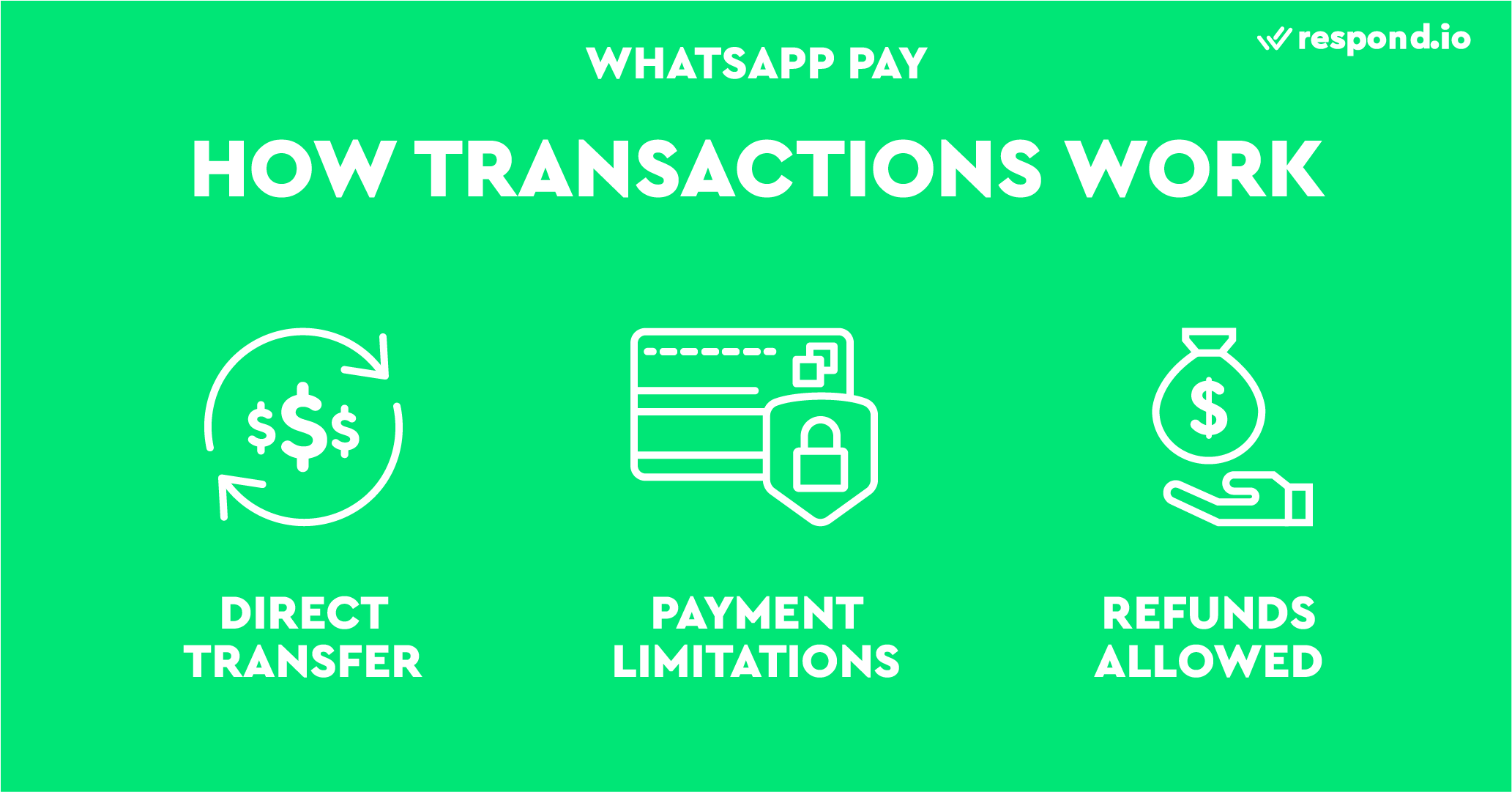

WhatsApp Payment: How Transactions Work

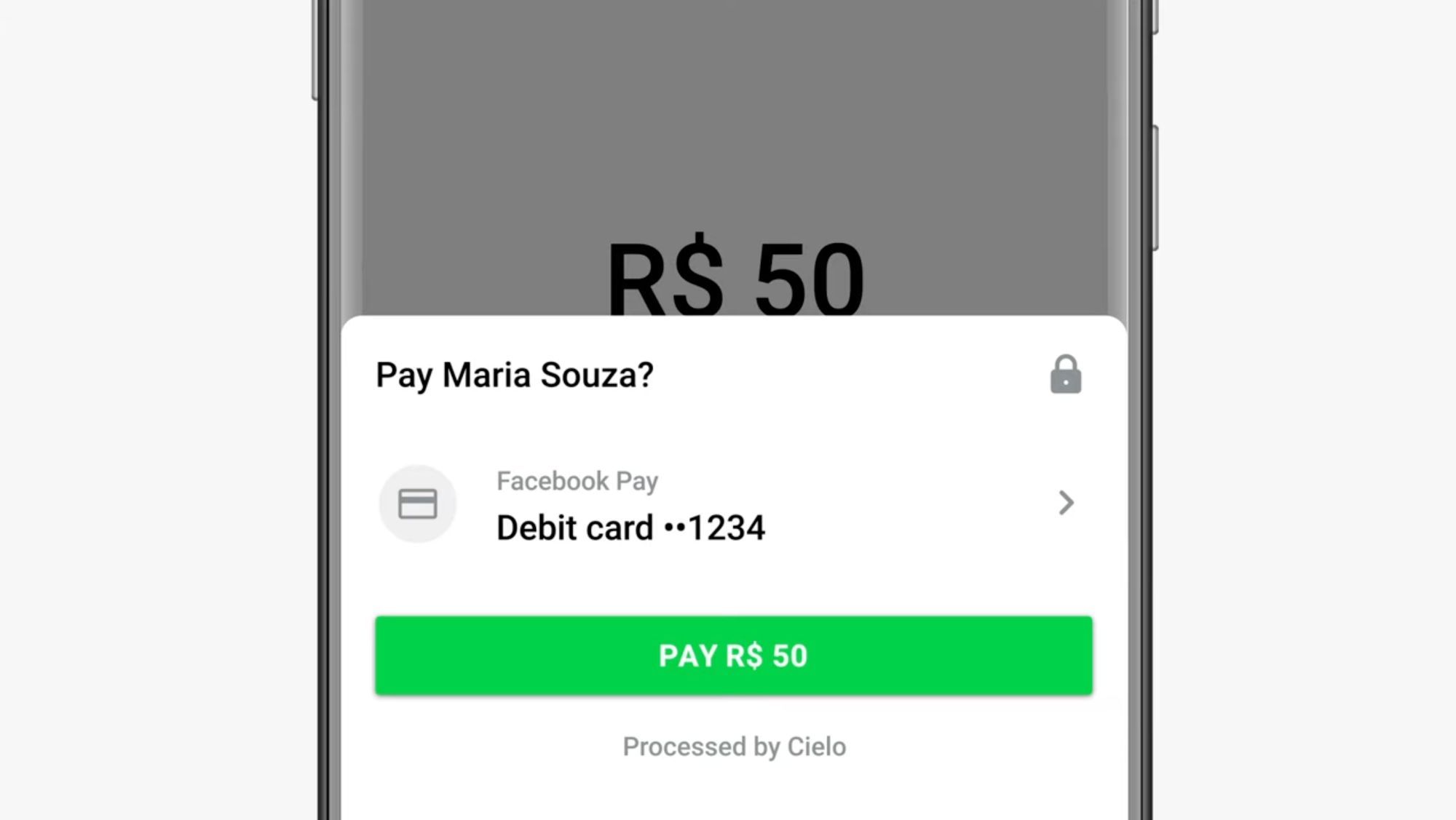

WhatsApp Pay Brazil is enabled by Facebook Pay and it’s processed by Cielo, the largest payment system company in Latin America. Thus, money is directly transferred between two Brazilian bank accounts.

Unfortunately, the Payment feature has some important limitations. Users can only send a maximum of R$1000 per transaction, 20 transactions per day, and send or receive R$5000 per month. It takes about two working days to get paid after initiating transfers.

The transaction status such as Completed, In Process, or Failed is indicated in the chat. Users can also view their transaction records from Settings in the WhatsApp Business App. In case of a failed transaction, the money is retrieved in 24h.

In the event you want to process a refund, it is possible via the Cielo dashboard. And for any issue that businesses may face, WhatsApp offers support 24h a day, 7 days a week. With this information in mind, let’s set up WhatsApp Pay in a Business Account.

Turn conversations into customers with respond.io's official WhatsApp API ✨

Manage WhatsApp calls and chats in one place!

WhatsApp Payment: How to Set Up

As mentioned, there are three ways to enable WhatsApp Pay:

Enable WhatsApp Payment yourself.

Do it through your bank.

Get it from a Contact.

Before setting it up, make sure you own a Visa or MasterCard, a WhatsApp Business Account, and a supported bank account. Next, we'll show you how to enable it in three different ways so you can choose the one that suits you best.

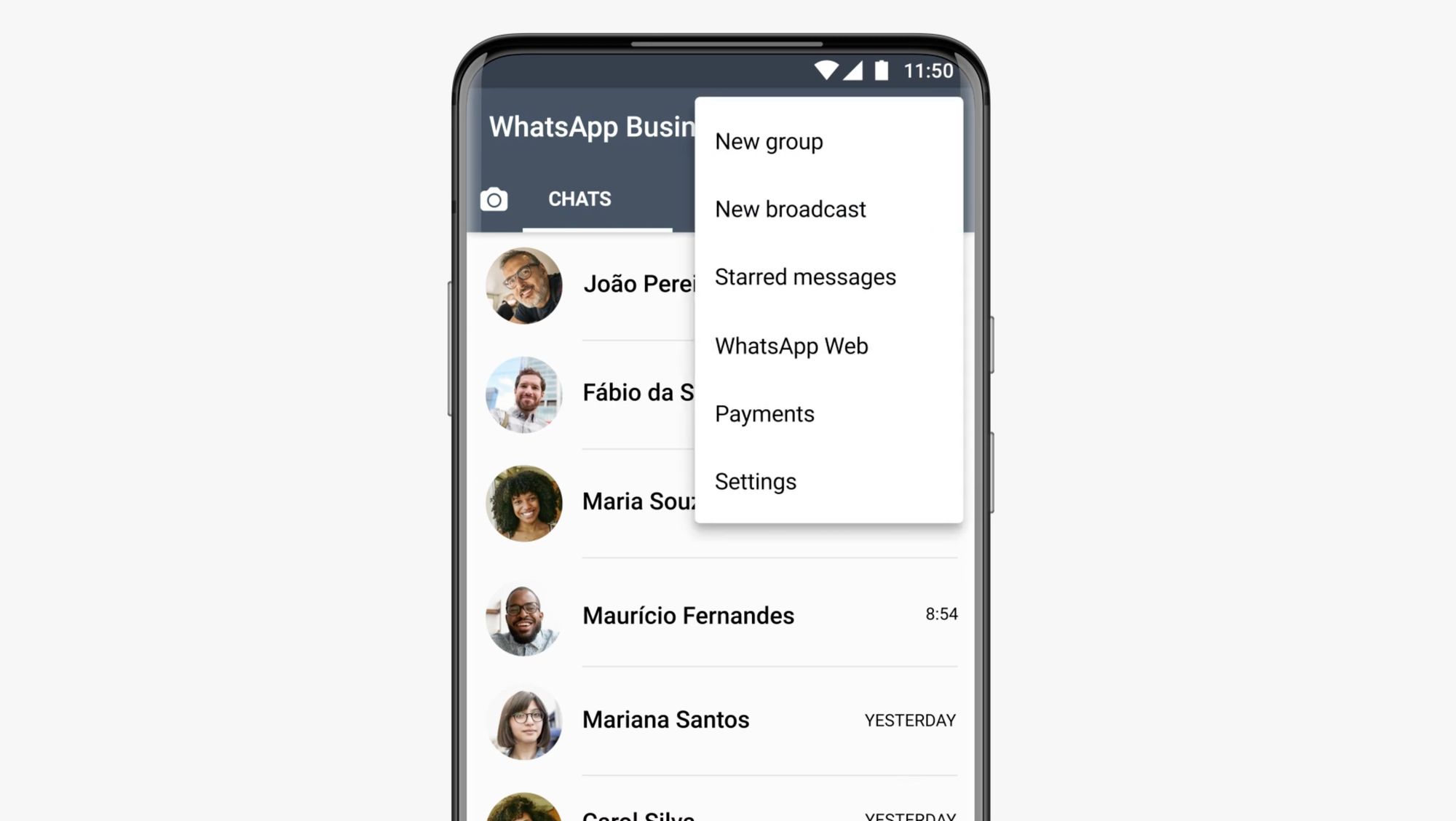

Enable WhatsApp Payment Yourself

Firstly, update your WhatsApp Business App to the latest firmware. Your WhatsApp Account number should also be the same as your bank account phone number. If you meet the requisites, follow these steps to set up WhatsApp Pay for business.

1. Go to Payments on your WhatsApp Business App.

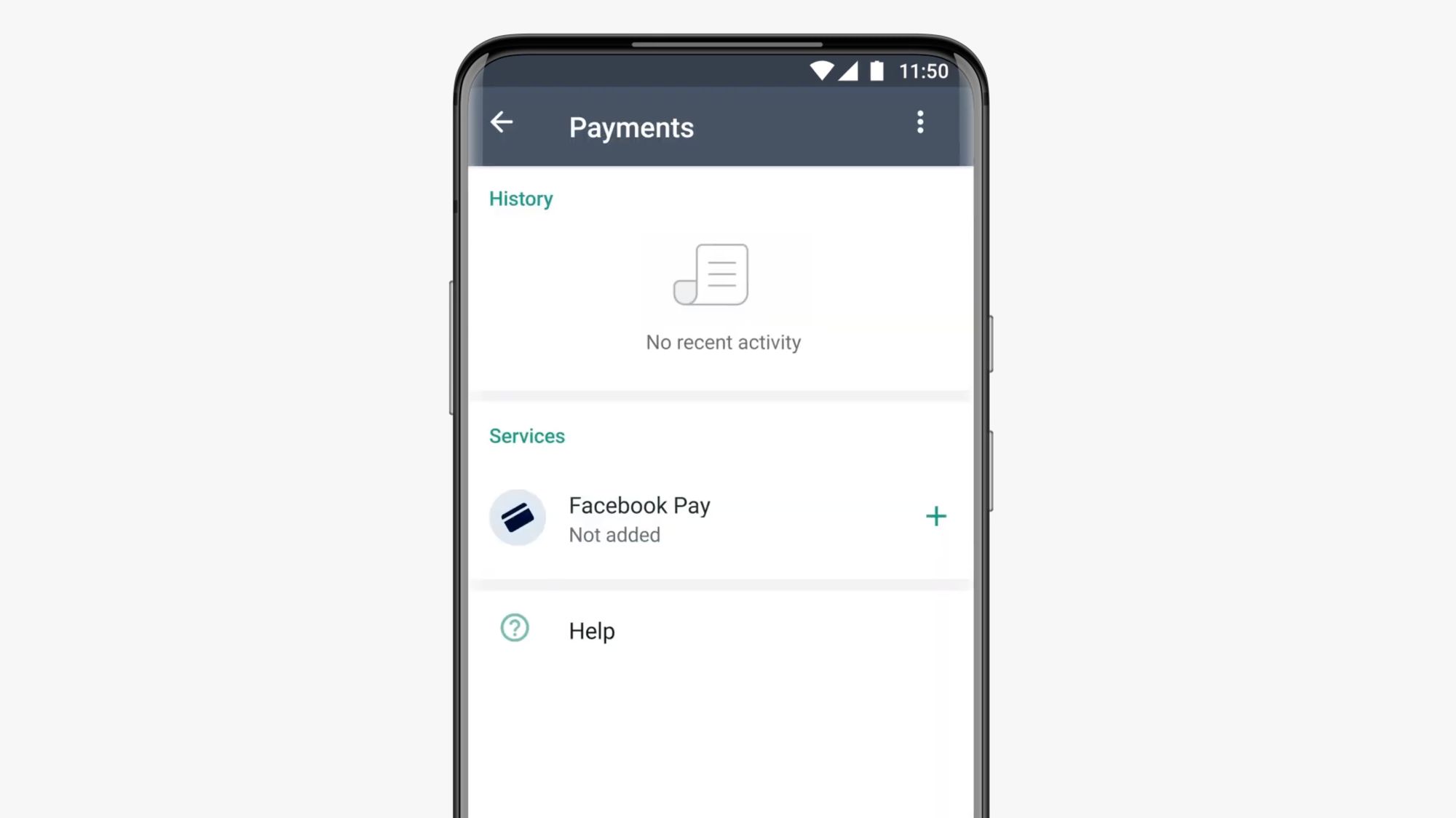

2. Tap the + button to add Facebook Pay.

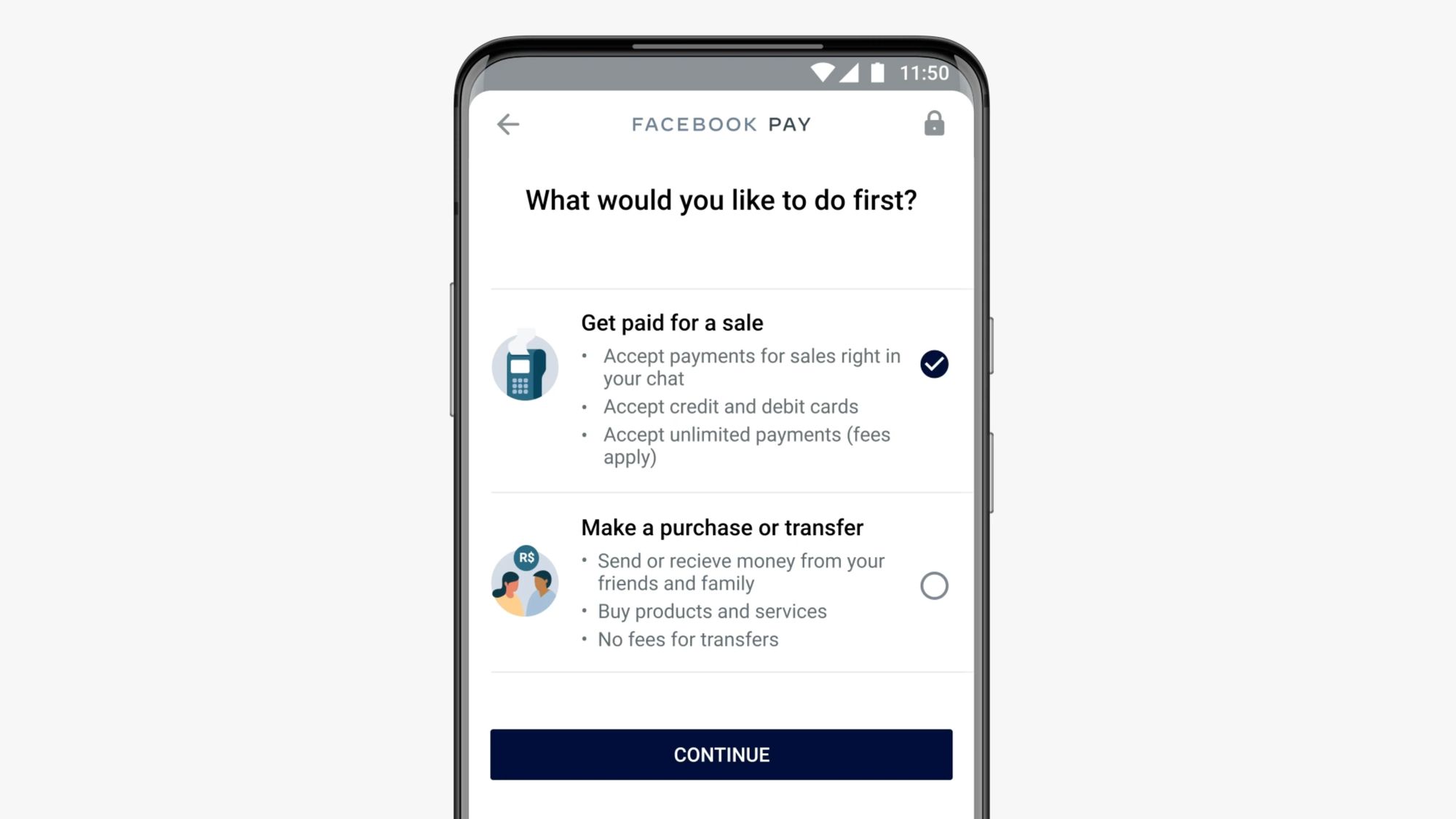

3. Check Get Paid for a Sale.

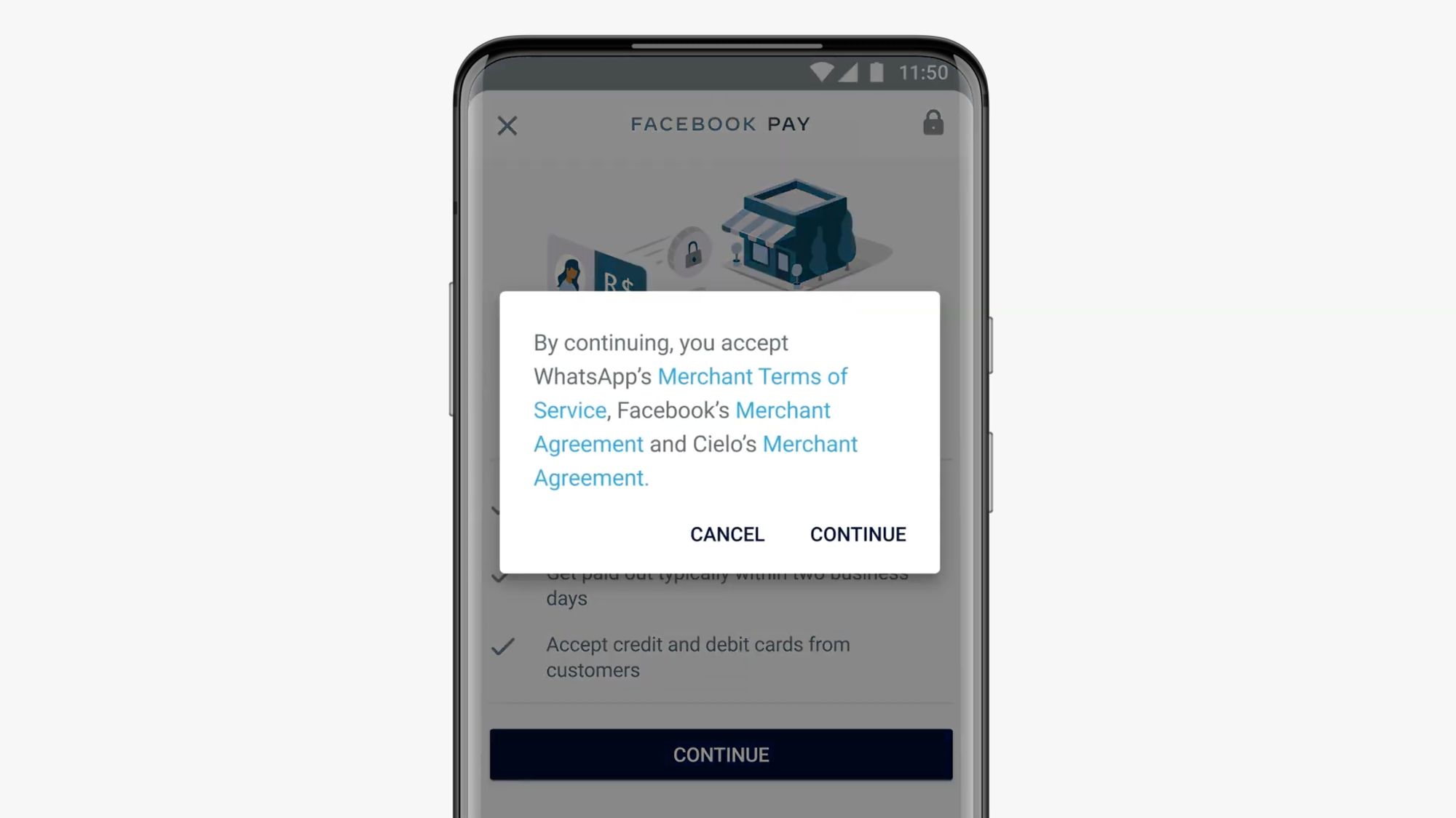

4. Accept WhatsApp, Facebook, and Cielo’s terms and conditions.

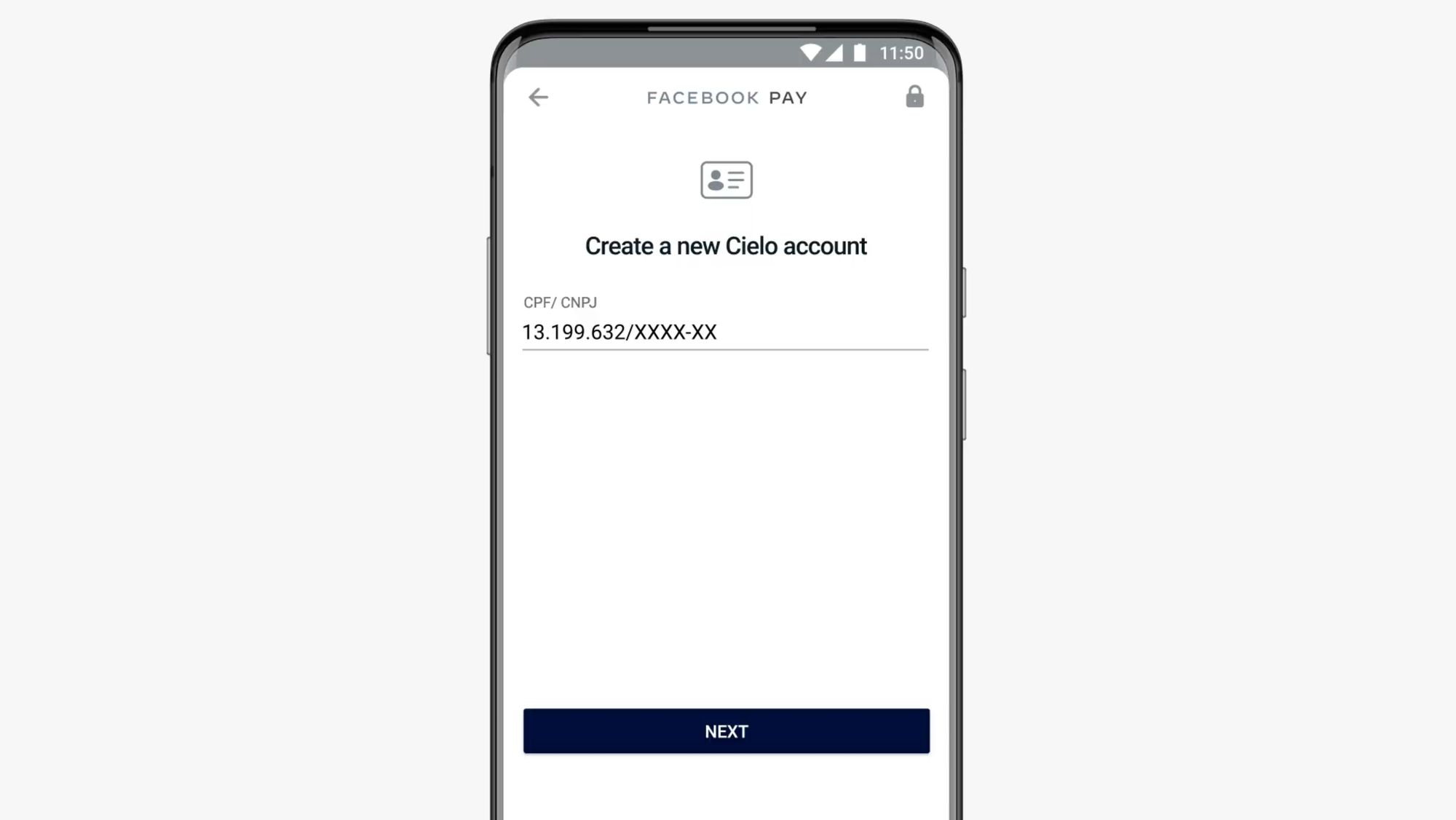

5. Set up a new merchant account with Cielo.

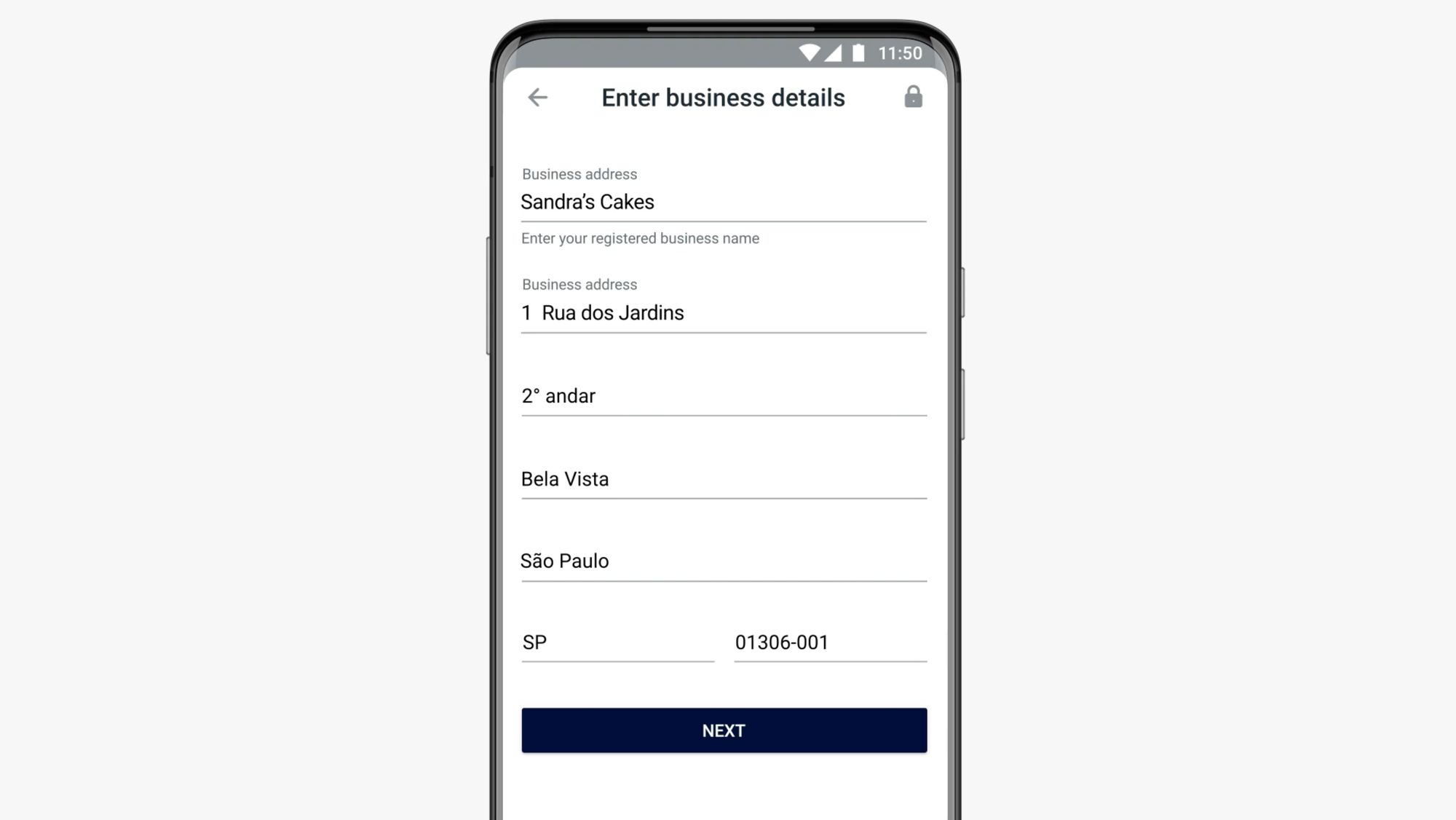

6. Enter your business details as registered legally.

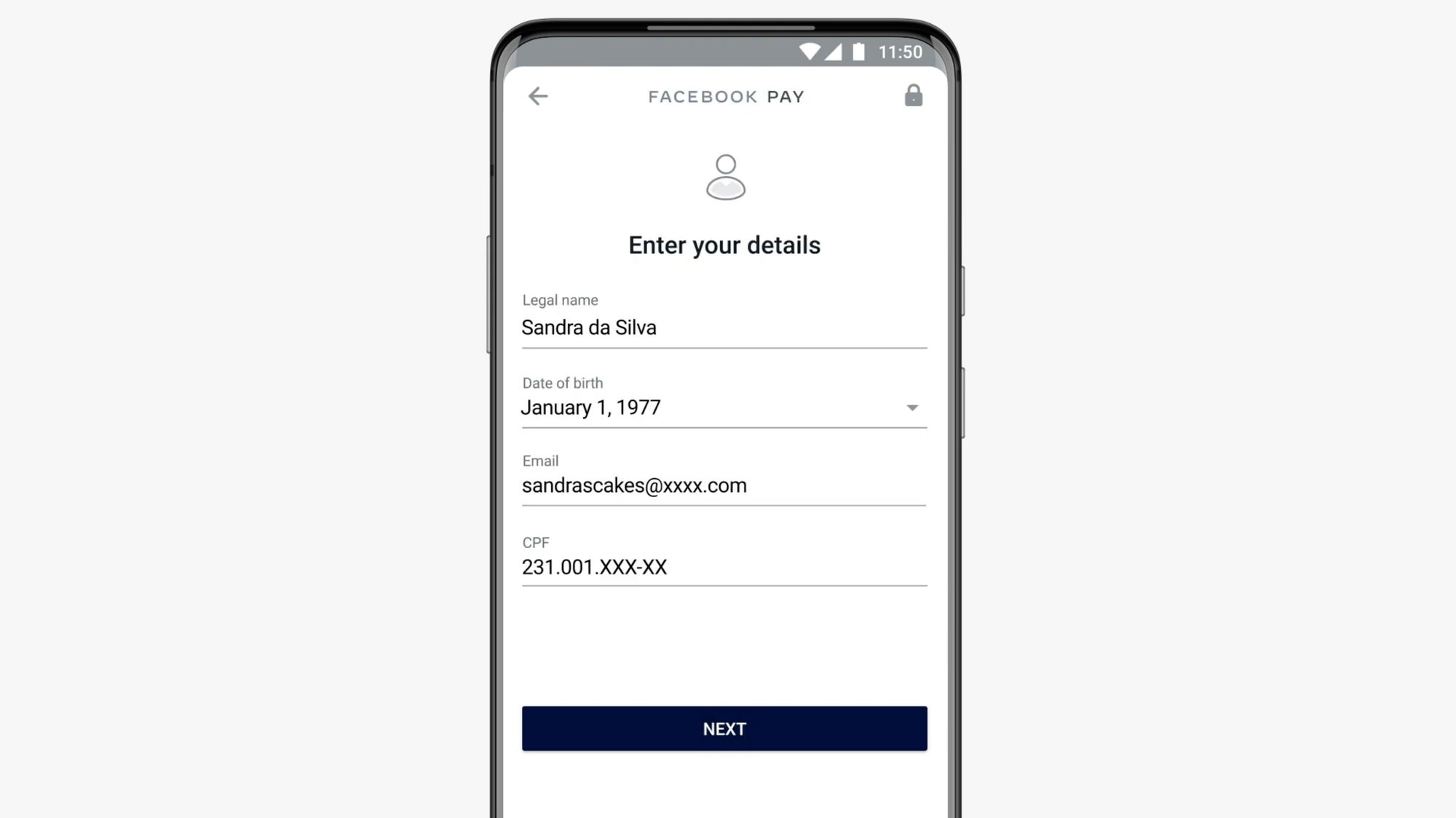

7. Enter your personal details.

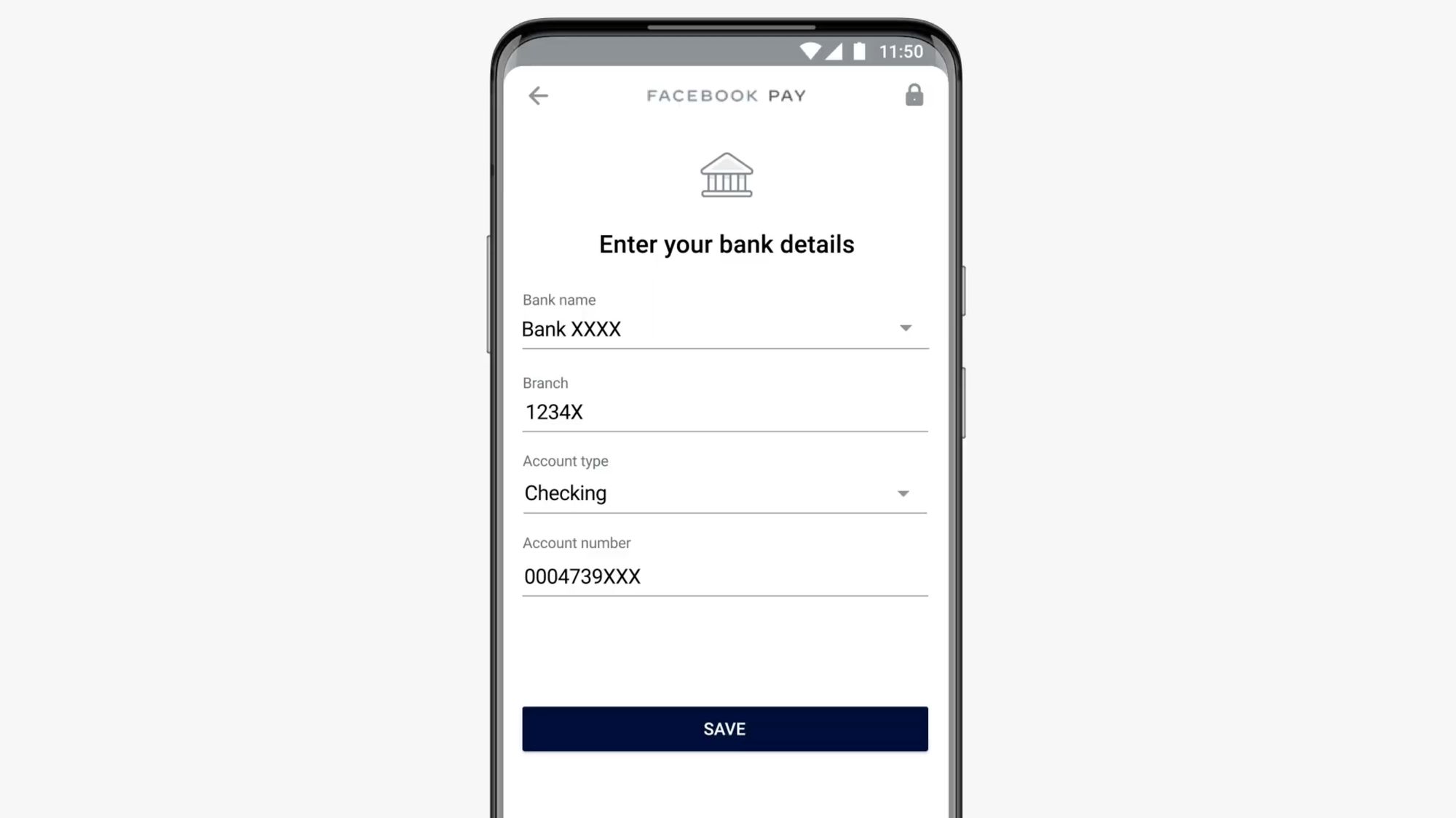

8. Key in your bank details, make sure your information is correct.

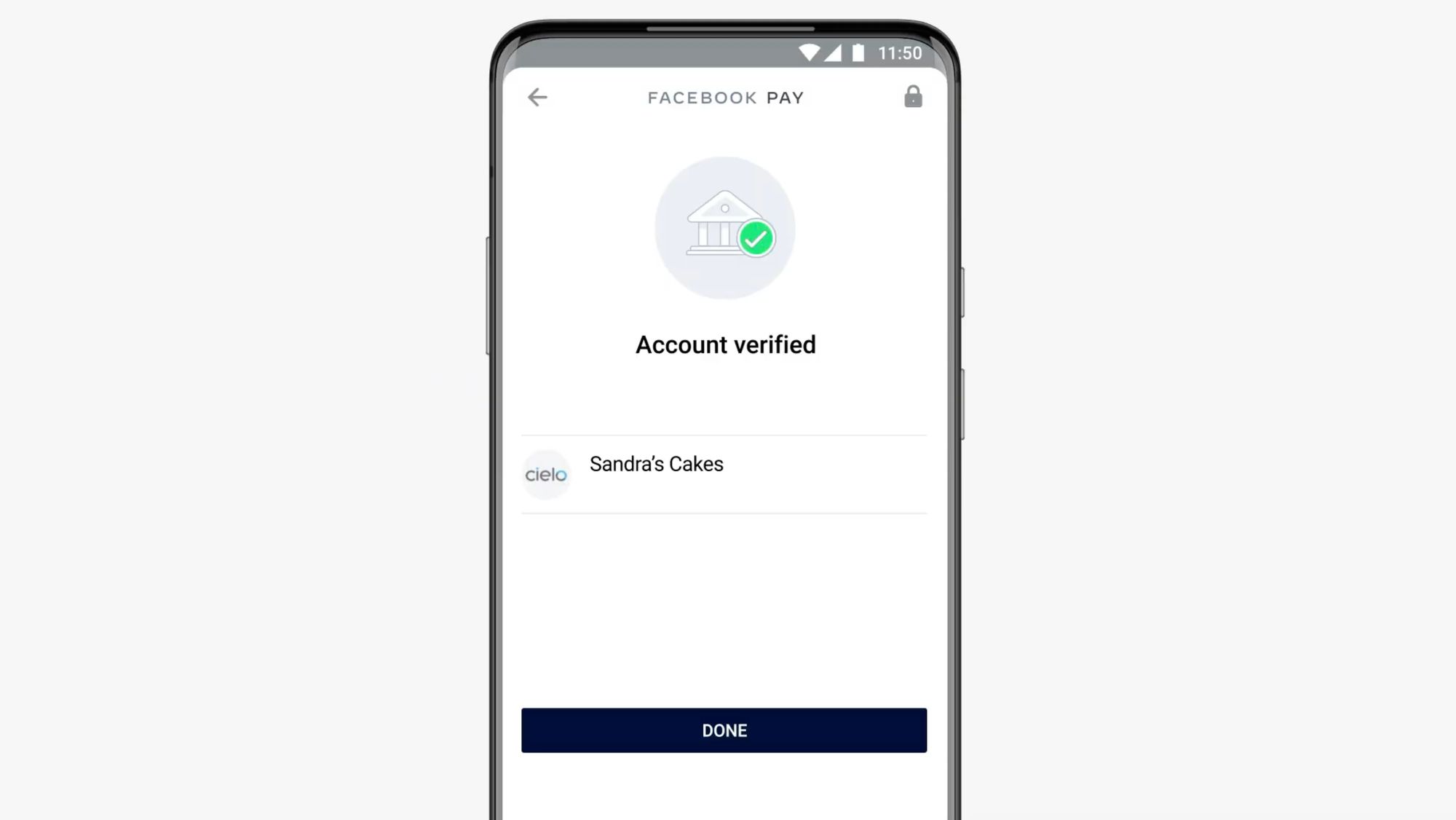

9. Verify your account and done.

Keep in mind that the verification process may take a while to complete. Once verified, you may have to wait up to 3 business days to be able to receive transactions.

Enable WhatsApp Payment Through Your Bank

If you can’t find the Payment option after updating the Business App, here’s a workaround. By visiting the official Bank app or contacting their customer service should guide Users through the whole process.

Currently, 9 Brazilian banks are facilitating this new feature for their clients. You can check the list of accepted banks on this site.

Some banks are issuing invitations in their own apps notifying clients about the novelty, whereas others encourage you to do it directly from WhatsApp. Once you have WhatsApp Payment activated, simply follow the steps from Enable WhatsApp Payment Yourself.

Get WhatsApp Payment From A Contact Transfer

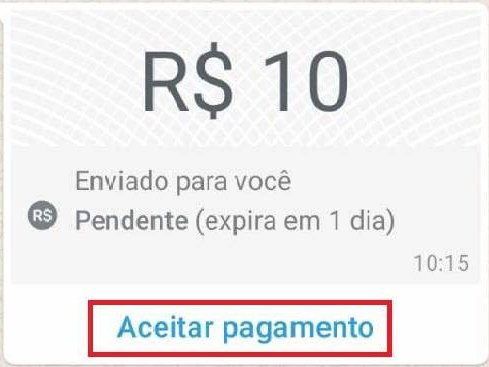

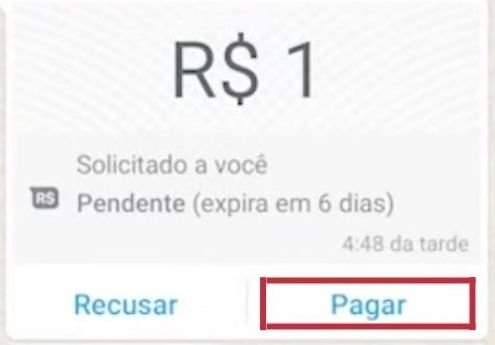

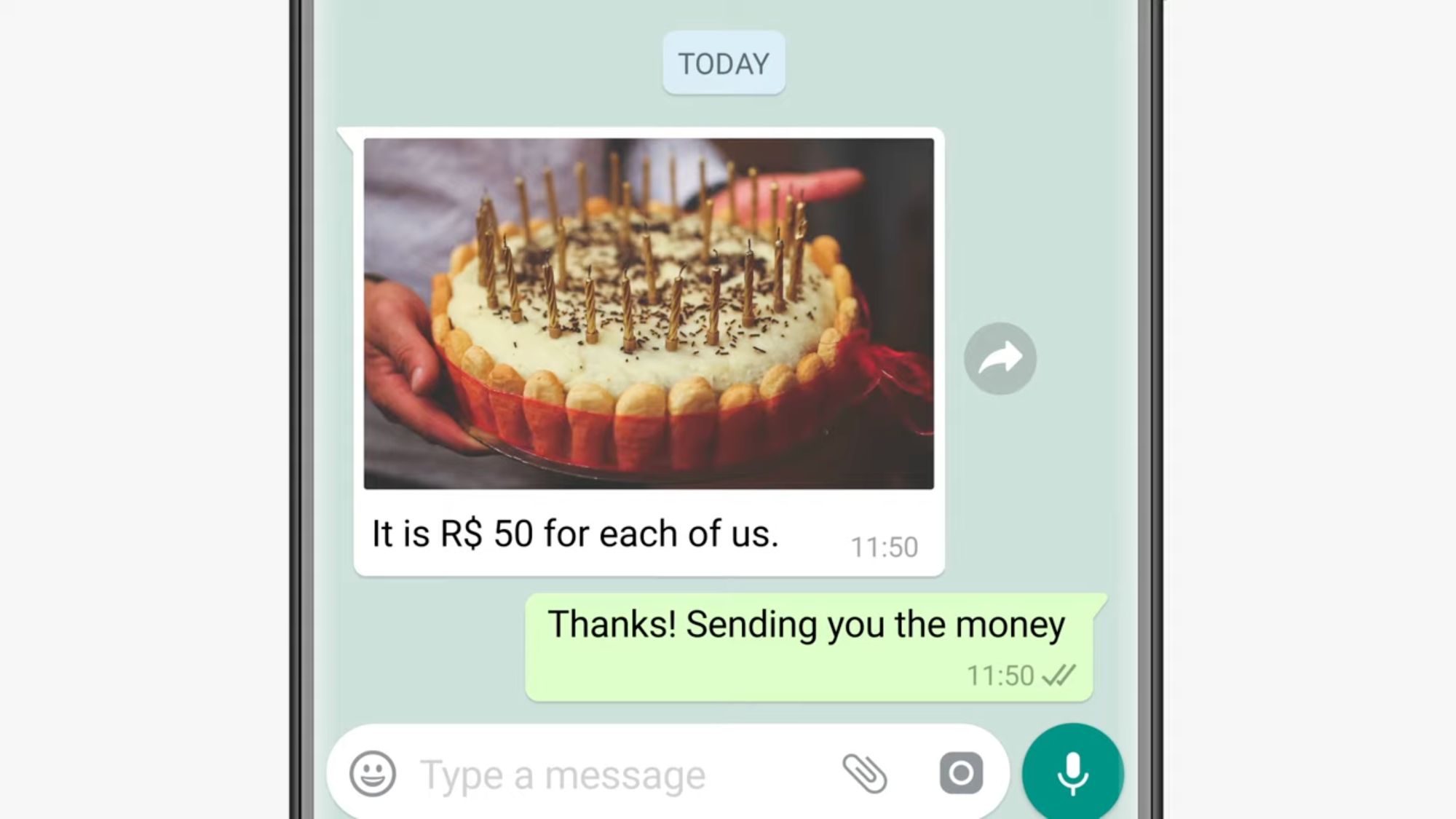

Do you know someone who is already using WhatsApp Pay? Then this is your lucky day. When one of your Contacts sends you a payment or payment request, this is also an invitation to activate WhatsApp Pay on your phone.

Let’s say a Contact wants to send you payment over WhatsApp Pay. Simply tap Accept Payment on the chat notification and go through the registration process. Similarly, tap Pay on the chat notification if a Contact requests you a transfer over WhatsApp Pay.

Users must complete the registration to activate the feature before receiving or sending any amount. Then, accept the relevant terms & conditions and create a Facebook Pay pin. Lastly, enter your details as shown in Enable WhatsApp Payment Yourself.

As you can see, there are two ways of activating this feature via Contact transfer. Have you decided on which method to use? In that case, let's move along to the next section. We'll discuss how to make payments to your Contacts.

Initiating a WhatsApp Payment

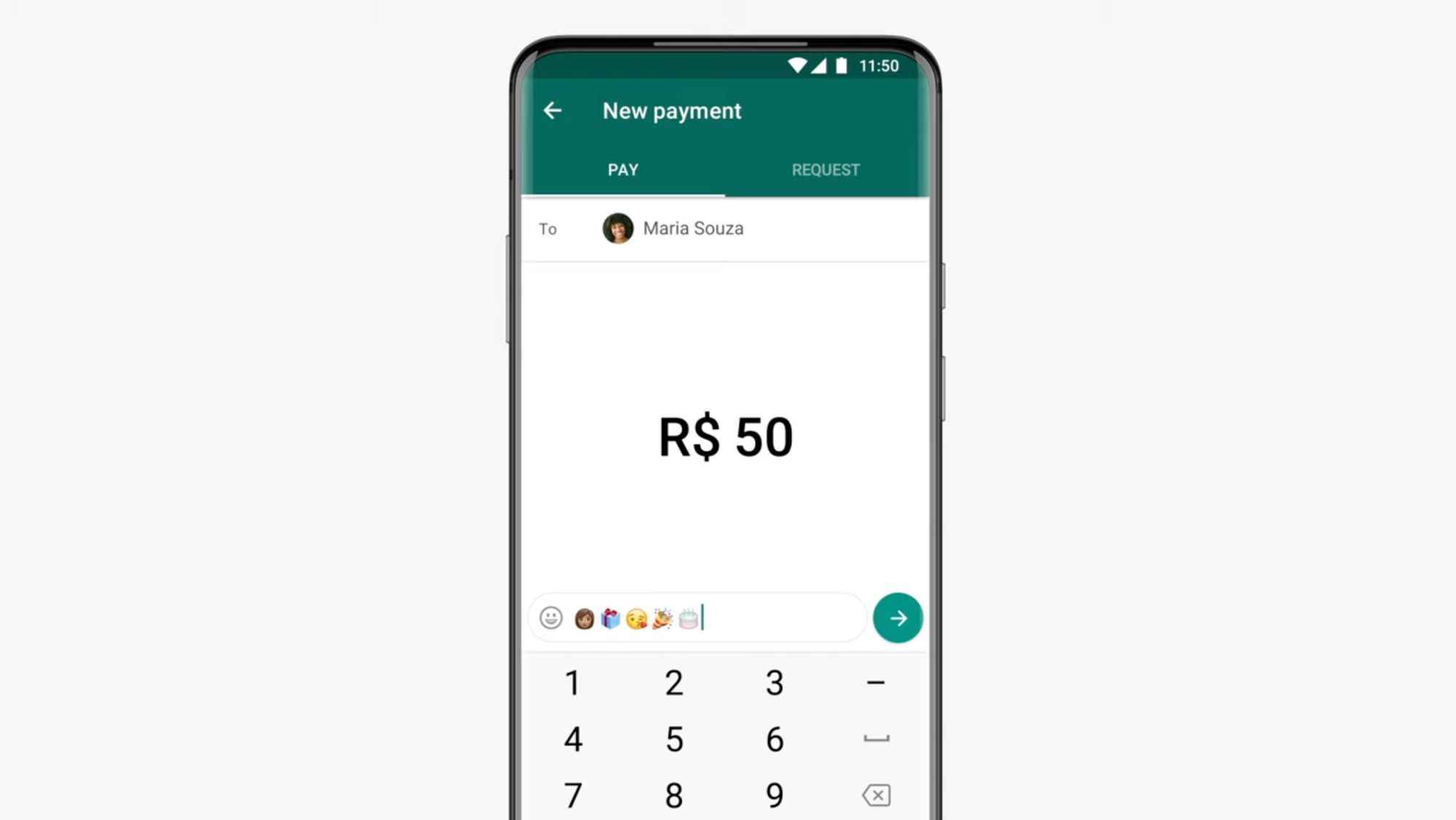

After your bank account and WhatsApp Account are linked, transactions are simple in-app processes. These are the steps to follow:

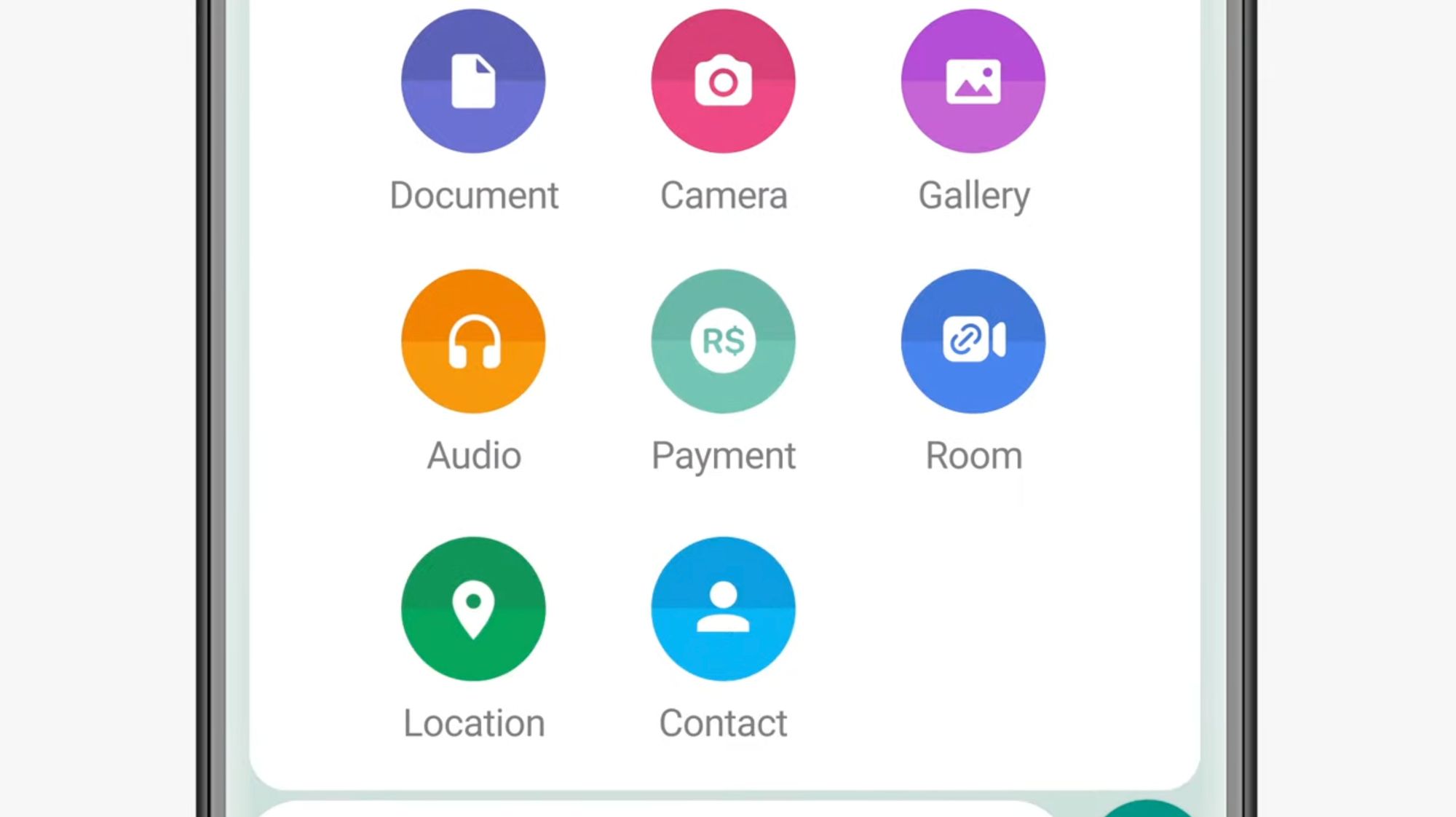

1. Open conversation with your Contact.

2. Select the paper clip icon on the message box and choose Payment.

3. Type the amount you want to transfer. There’s an option to add a note.

4. Tap Pay.

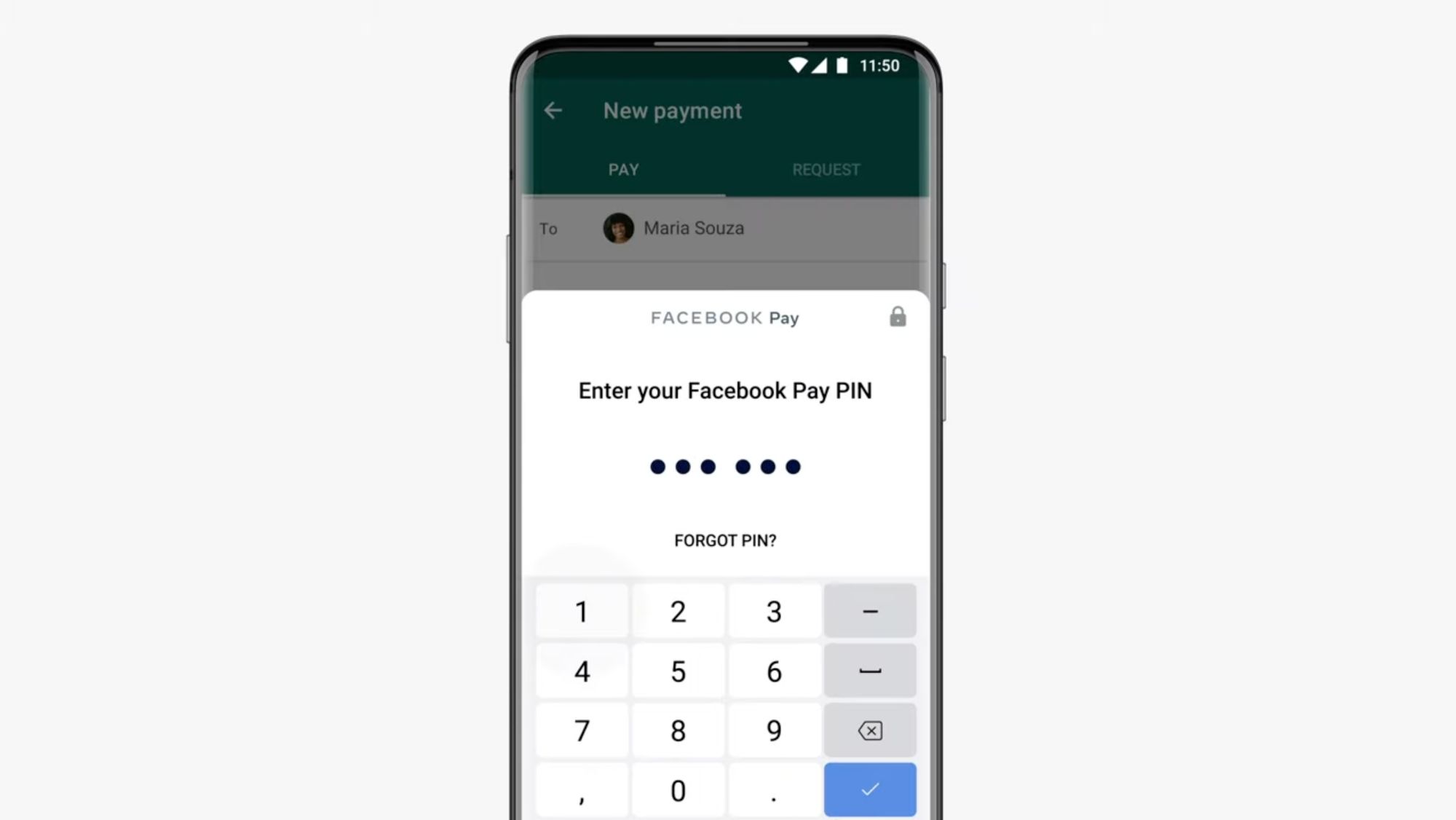

5. Enter your Facebook Pay pin.

6. Check and you will see the transfer status in the chat.

Additionally, Users also have the option to request payments from their Contacts. After tapping on Payment, choose the option Request instead of Pay. To conclude, insert the desired amount and add a note for context if you wish.

Hopefully, the information in this blog post has answered your questions related to WhatsApp Pay. While it seems like another good payment alternative for businesses, should they actually adopt it?

Turn conversations into customers with respond.io's official WhatsApp API ✨

Manage WhatsApp calls and chats in one place!

WhatsApp Pay: To Use or Not to Use

WhatsApp Pay is still unavailable in most countries and it's not expanding as quickly as it was expected due to regulatory issues. In fact, concerns over privacy and fair competition are holding it back.

A recent survey by Akamai Technologies reveals that 60,36% of Brazilians don’t trust WhatsApp Pay as a payment method. Even so, there are 43,7% more WhatsApp Pay Users than last year in Brazil. It makes sense since WhatsApp is the most popular app in the country.

All in all, the new WhatsApp Payment feature allows easy transfers, yet it still has a few limitations. Ultimately, it’s up to the Users to decide if WhatsApp Pay is for them considering the pros and cons.

Further Reading

If you found this blog useful, here are some other blogs that might interest you:

Electronics

Electronics Fashion & Apparel

Fashion & Apparel Furniture

Furniture Jewelry and Watches

Jewelry and Watches

Afterschool Activities

Afterschool Activities Sport & Fitness

Sport & Fitness

Beauty Center

Beauty Center Dental Clinic

Dental Clinic Medical Clinic

Medical Clinic

Home Cleaning & Maid Services

Home Cleaning & Maid Services Photography & Videography

Photography & Videography

Car Dealership

Car Dealership

Travel Agency & Tour Operator

Travel Agency & Tour Operator